Yes, you can get a home loan with a work permit, even without US credit history.

Updated on June 21, 2024

No US Credit Needed

Foreign Income and Credit Accepted

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

The answer is Yes! Getting a mortgage with an Employment Authorization Document (EAD) is possible and simple. All you need are a few qualifications and the correct information about the appropriate loan options and procedures. Many Employment Authorization Card holders benefit from the various mortgage options every year. You can also own property by getting a mortgage based on your EAD soon!

This article presents you with the best mortgage options available on an EAD in the USA. But before that, for the benefit of the unversed, let’s brush up on the concept of the Employment Authorization Card before discussing the mortgage.

An EAD, or Employment Authorization Document, is issued by the United States Citizenship and Immigration Services (USCIS), allowing a non-citizen to work legally in the USA. It permits non-citizens to obtain employment in most professional fields. An Employment Authorization Card is typically valid for two years but can be renewed indefinitely.

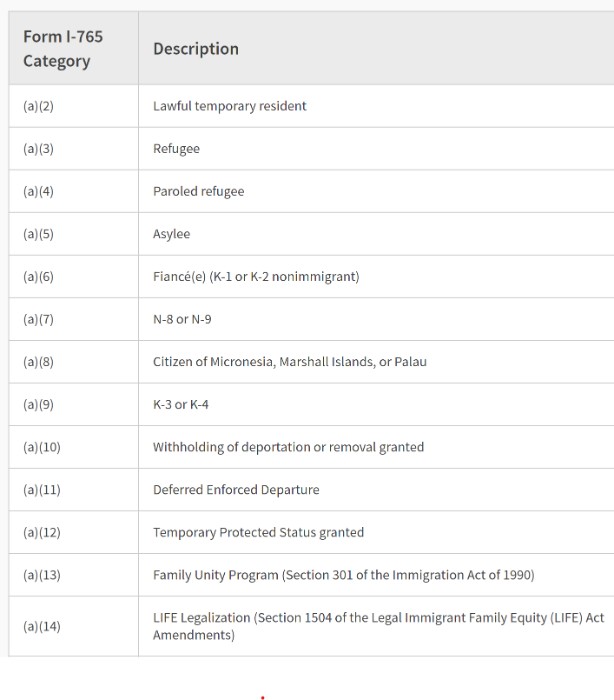

To be eligible for an EAD, the non-citizen must fall into one of these categories to have a permit from USCIS to work in the US.

Some visa holders have work permits included in their visas, while other types of visas may not have such privileges attached to them. In such cases, seeking an employment authorization card to apply for a mortgage is essential. In addition, it helps the lender assess the borrower’s financial stability and loan repayment capacity.

For example, if you are in the US with a student visa, you may not qualify for some mortgages because lenders consider it an unstable income source. At the same time, holders of H-1 or green cards may be eligible for most loan programs. However, if you get an Employment Authorization Card on your F1 Visa, lenders will be willing to provide you with the mortgage.

Yes, visa holders can obtain an EAD mortgage. However, depending on their residency status, the requirements may vary.

EAD Mortgage with No US Credit

It’s typical to have no US or thin US credit, if you recently moved to the US. However, this can not be the reason to stop you from getting a home. You have the option of foreign national mortgages, which you can get with no US credit to buy your home in the US.

For borrowers with a green card, the mortgage process is very similar to that of US citizens. The only extra documents they need to provide the lender with is Form 1-551 to prove the validity of their green card and Social Security Card.

Note: It is important to note here that the work permit document must indicate the applicant’s eligibility for working in the US for at least two years to get approved for the mortgage.

EAD Mortgage with Established US Credit

If you are in the US for a decent time and you have a good credit score, then you can easily qualify for conventional loans along with the foreign national mortgages.

HomeAbroad specializes in providing US mortgages for foreign nationals, including expats, newcomers, and non-resident investors buying primary residences, second homes, or investment property. Get a quote today!

Pre-qualify for a US mortgage as a foreigner.

No US credit history needed.

Visa holders on EAD can buy homes on the condition that the home will be used as their primary residence. The borrowers who are visa holders on Employment Authorization Card can buy homes, such as single-family residences, condominiums, cooperative housing, etc., to live in and not earn an income. Therefore, they must have enough budget to make monthly repayments post approval of the mortgage and for the initial down payment and closing costs.

The answer is yes – getting a home loan with an Employment Authorization Card (EAD) is possible. An Employment Authorization Card card issued by US Citizenship and Immigration Services (USCIS) gives a foreign national the right to work in the United States for up to two years.

To qualify for this type of loan, you must meet the exact basic requirements of someone with US citizenship or permanent residency status. This means that you will need a steady source of income and financial stability to sustain the mortgage’s principal and interest rates.

It is important to note that lenders may have different rules and requirements regarding mortgages for foreign nationals. Therefore, it is best to talk to a mortgage specialist who can help you understand the process and find the best loan option.

HomeAbroad provides foreign national mortgage programs with no US credit history, and you can contact us for a quick quote and preapproval.

Knowing about qualification criteria is the first step towards getting a mortgage with an employment authorization document. The next step is picking the right mortgage plan to help you achieve your investment goals within a given time frame with utmost convenience and ease.

Let’s now look at the various loan types you can get approved with the help of an EAD number or Individual Tax Identification Number (ITIN ).

This loan is offered both by the government and private lenders. The difference between the two is that government-backed loans will scrutinize your credit history, employment history, pay stubs, tax returns, etc. At the same time, private lenders are open to more flexible working methods and often forgo stringent scrutiny, making the process way more convenient and faster. Private lenders primarily consider your capability of repaying a loan by taking into account your credit score in your home country or the credit score of your co-borrower.

If you are looking to buy an investment property through a mortgage with an employment authorization document, then DSCR is a great option, as this loan purely operates on positive cash flow generated by the property. DSCR stands for Debt Service Coverage Ratio and analyzes a property’s income performance and ability to pay the loan.

The cash available after paying all expenses, debts, and taxes divided by annual debt service must be more than 1.25 for you to qualify for getting this loan. So to get approved for DSCR, you need a promising property and enough cash for the down payment and closing costs.

The Federal Housing Administration (FHA) is a division of the US Department of Housing and Urban Development (HUD). FHA loan is a government-backed loan and considers the borrower’s credit history for approving the loan, which delays the home-buying process minimum by two years.

These loans are available to citizens, non-citizens with eligibility under US laws, and holders of EADs. As a non-citizen, you can qualify as long as you’ve been a legal resident in the US (with an EAD) for at least two years and have a valid work permit.

They often come with a long list of requirements like bank statements, income proof, tax returns, etc., which makes the home-buying process lengthy and cumbersome.

A conventional loan is a mortgage backed by Freddie Mac and Fannie Mae. You may qualify for this loan if you fulfil specific criteria like having an income source, proof of employment, earning enough money to pay off your debts, etc.

No matter which type of mortgage you choose, make sure to do your due diligence before settling on one. This will help you make an informed decision and get the most out of your mortgage.

The next step towards getting a mortgage is getting the required documents.

Following are the documents required for getting a mortgage with an employment authorization document.

This document is issued by the US Citizenship and Immigration Services (USCIS) that verifies your eligibility to work in the United States.

This includes documents like pay stubs, bank statements showing regular deposits, etc. The lender will scrutinize these to verify your ability to repay this loan.

You should have documents proving that you have been living in the United States for at least two years.

The lender will contact your employer to confirm your work status and income.

Your driver’s license will be used to verify your identity.

You must provide your social security number for the lender to conduct a credit check.

Your credit report will be used to assess your creditworthiness and determine the interest rate you will receive.

Your lender will review your tax returns to verify that you have been filing taxes in the US for at least two years.

Once all the above documents are ready, you can proceed with the mortgage application process. The lenders will evaluate all these documents and assess your creditworthiness before approving or denying your loan request. If approved, you will need to complete the associated paperwork and eventually provide the down payment and closing cost.

Once your documents are sorted, it’s time to kick-start the process and inching closer to obtaining the ownership of your dream property.

Following are the steps to obtaining an EAD mortgage.

The first step is to find the right property. Then, evaluate different properties and decide on the one best suits your needs. You can seek help from friends and family or rely on the knowledge and experience of a real estate agent. HomeAbroad has a vast network of CIPS agents who are well-versed in the home requirements of non-permanent residents. You can connect with them through HomeAbroad for free!

Connect with a HomeAbroad real estate agent in your area.